Case Study: How Realistic Utility Bill Templates Improve Budgeting Skills in Adult Education

Background:

The Financial Empowerment Center (FEC) is a nonprofit organization providing free workshops focused on budgeting, debt reduction, and financial literacy. Their target audience includes low-income adults — many of whom are single parents or working multiple jobs. A common challenge among participants was managing household expenses, especially unpredictable utility costs like electricity, water, and internet.

To bridge the gap between theory and real-world application, FEC wanted to integrate realistic utility bill templates into their sessions. The idea was to help participants understand how to read, track, and plan around monthly utility expenses — a skill many had never formally learned.

Why Utility Bills Are Essential in Budgeting Education

A utility bill is more than just a payment reminder — it reflects daily consumption patterns, billing cycles, and seasonal variability. By using realistic templates, learners could:

- Visualize usage and due dates clearly;

- Prepare for sudden cost increases (e.g., higher internet fees or water charges);

- Prioritize core household needs when income is limited;

- Build confidence in making financial trade-offs.

Generic spreadsheets and theory-heavy lessons didn’t connect with participants. But realistic documents mirrored their lived experiences, making financial planning easier to grasp and apply.

Solution:

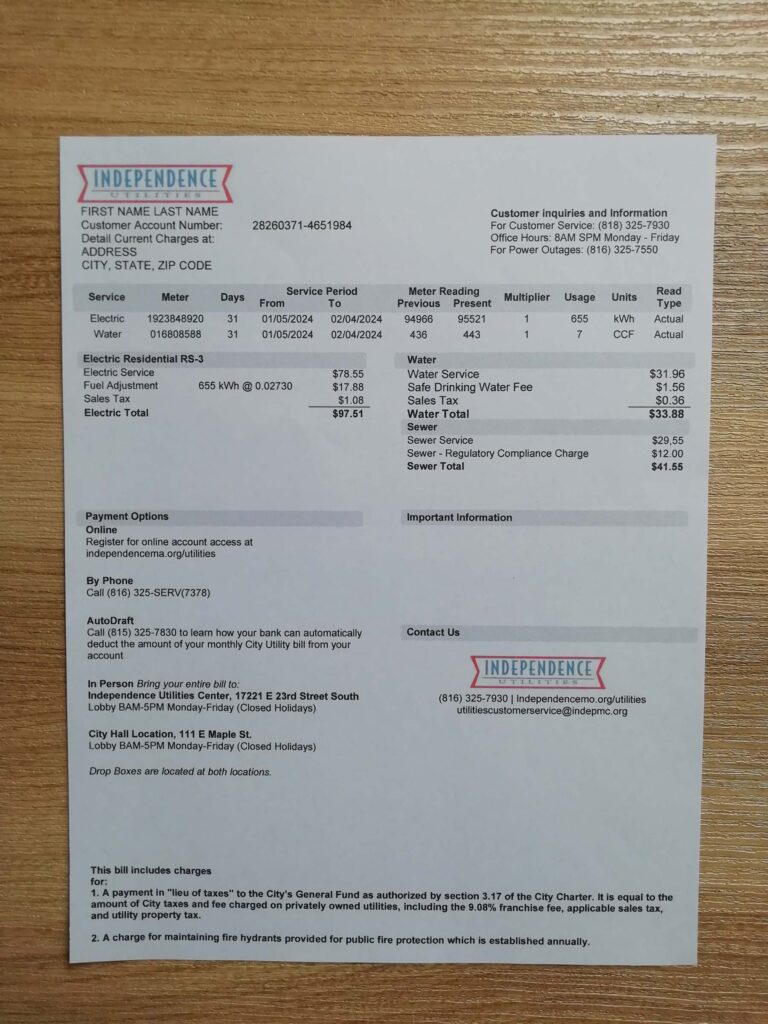

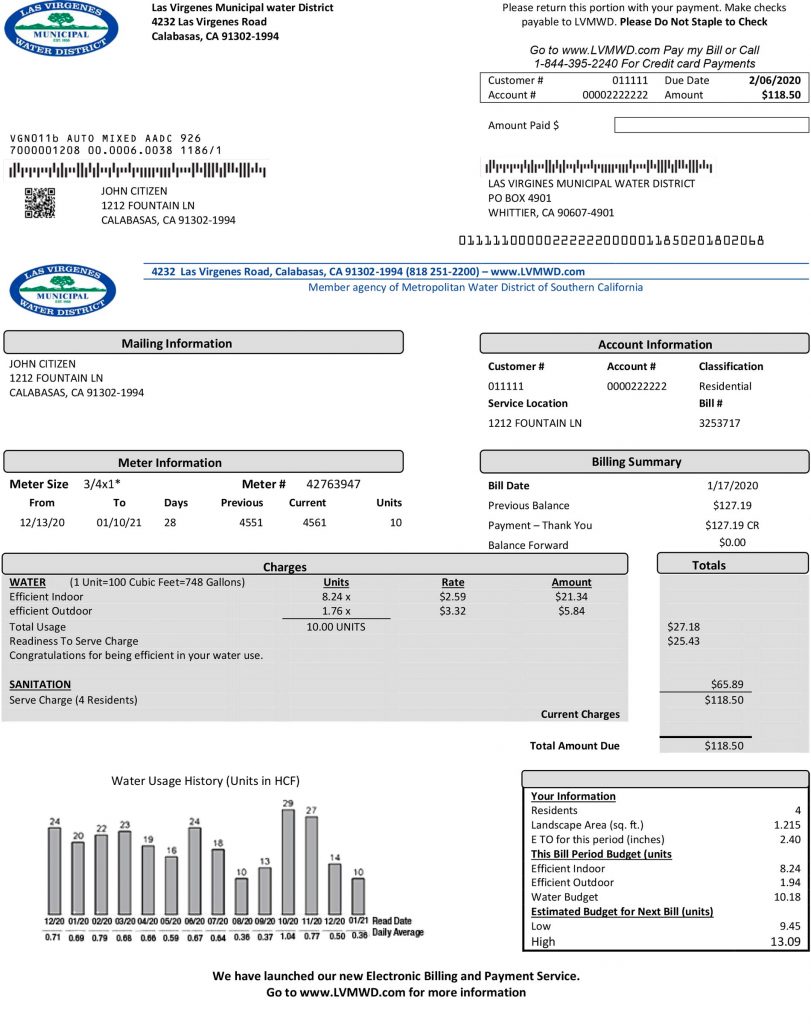

FEC partnered with Brand-Utility.com to develop a series of editable utility bill templates tailored for educational use. These templates were carefully designed to look and feel like actual documents — with proper formatting, usage charts, totals, and due dates — while remaining fully customizable.

Each training packet included:

- Water, electricity, and internet bills;

- Realistic data fields for name, address, usage, and billing periods;

- Editable sections for hands-on interaction;

- Surprise scenarios (e.g., an unexpected $35 charge spike) to simulate real-life unpredictability.

Participants used printed or digital versions to simulate monthly planning and track how one change could impact their full budget.

How It Was Implemented (Step by Step)

- Introduction — Learners were introduced to the concepts of fixed vs. variable expenses.

- Hands-On Practice — Each participant received a utility bill to analyze and fill into a personal budget worksheet.

- Simulation Scenarios — Some documents featured sudden cost increases, requiring quick budget adjustments.

- Group Discussion — Learners reflected on how to prepare for and manage utility fluctuations within a limited budget.

Results: Confidence and Practical Understanding

The response from workshop attendees was overwhelmingly positive. One participant shared that she had never realized how much small changes in usage could affect her monthly bill — and how visualizing it helped her change habits.

Participants gained:

- Clear understanding of monthly billing structures;

- Greater control over income allocation;

- Confidence in handling unexpected expenses;

- A toolkit for making smarter, long-term financial decisions.

Why Custom Templates Work So Well

| ✅ Benefit | 💬 Why It Matters |

| Visual layout | Helps learners see charges and breakdowns clearly |

| Interactive format | Encourages hands-on learning, not passive theory |

| Adaptable content | Easy to edit based on region or training level |

| Realistic experience | Prepares users for actual financial management |

| Emotional relevance | Matches the learners’ real challenges |

Free Checklist for Trainers: How to Use Utility Bills in Education

If you’re a nonprofit, trainer, or educational program coordinator, here’s how to implement utility bills in your curriculum:

- ✅ Choose utility types that reflect real student needs;

- ✅ Include billing periods, usage charts, and due dates;

- ✅ Simulate sudden bill changes (e.g., seasonal spikes);

- ✅ Combine with tracking sheets and budget planners;

- ✅ Offer editable files in PDF or PSD for easy customization.

Want editable templates for training?

👉 Explore customizable utility bill formats for realistic financial education.

Conclusion: Practical, Ethical, and Impactful

This case study shows how realistic utility bill templates — when used ethically — can bridge the gap between theory and practice. Whether for adult learners, social impact programs, or personal finance education, these documents empower people to understand and manage their money better.

Brand-Utility.com provides custom-designed templates tailored for educational purposes, interface testing, simulations, and more. If you’re developing a program and need editable, scenario-ready utility bills — our team can help.